July Sees Continued US Market Gains — Will Disappointing Jobs Numbers Derail the Rally?

- Aug 1, 2025

- 3 min read

US Equity Rally Extends Into July

Despite ongoing tariff uncertainties and hawkish post FOMC meeting commentary towards the end of the month, US equities extended their rally into July amid resilient Q2 earnings, progress on trade negotiations, and improving consumer sentiment. The S&P 500 Index notched 10 all-time highs during the month alone. US growth (+3.4%) was the best performer, followed by US large-caps (+2.3%) and US mid-caps (+1.6%). Bonds were mixed as high yield credits and Treasury Inflation Protected Notes were up (+0.2% and +0.1%, respectively) while 7-10 year US Treasuries and municipal bonds fell (-0.6% and -0.3%, respectively). Likewise, commodity performance varied as crude oil and silver gained 8.9% and 1.6%, respectively, while broad based commodities and gold each decreased 0.6%.

Fed Holds Rates Steady, But Two Governors Dissent

The Federal Reserve held interest rates steady at the July FOMC meeting, keeping the fed funds rate at the 4.25–4.50% range. Chair Powell reiterated that policy remains modestly restrictive and emphasized the Committee’s focus on data dependency. Aside from recognizing that growth moderated in the first half of 2025, there were little changes in the policy statement. It continued to emphasize that the unemployment rate remains low, labor market conditions remain solid, and inflation remains somewhat elevated. Notably, two Fed Governors dissented in favor of a rate cut, reflecting concerns about weakening demand and marking the first such dissent since 1993. Although tariff and other supply-side pressures remain on watch, an employment report released just two days after the meeting evidenced deterioration in the labor market, causing markets to price in an 86% chance for a September rate cut and two cuts through year-end.

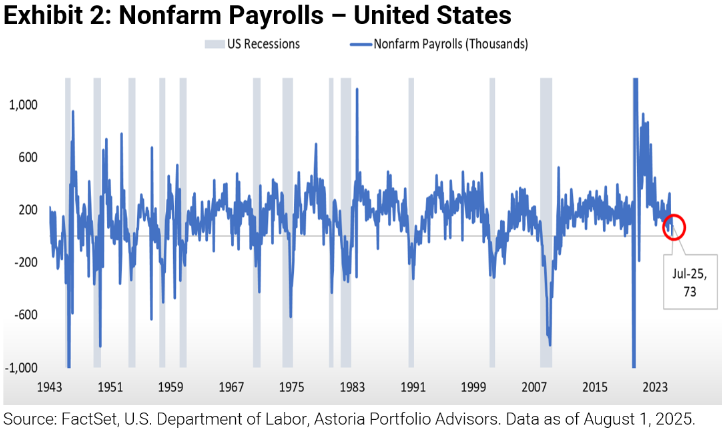

Weak Jobs Report Signals Softening Labor Market

Nonfarm Payrolls rose by just 73,000 in July, missing the 115,000 estimate. The past two months were revised downwards significantly, with May and June only adding 19,000 and 14,000 jobs, respectively. These readings mark some of the weakest prints since the post-pandemic recovery. The unemployment rate also inched up to 4.2% from 4.1%.

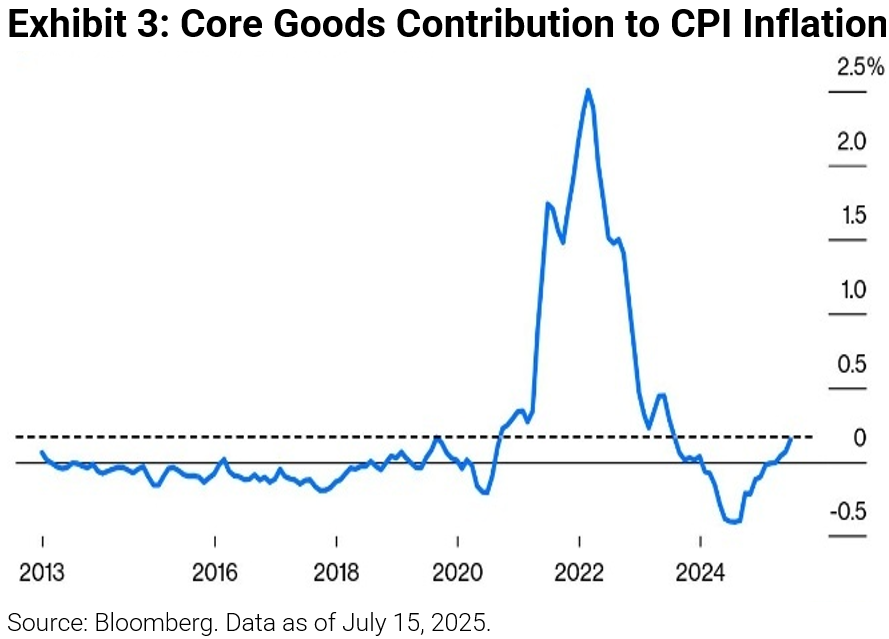

Core Goods Inflation Finds New Fuel

Although it’s not yet at an alarming level, core goods inflation is now rising at its fastest pace in more than a decade outside of the pandemic-spike, likely due to tariffs. Prices across toys, appliances, and household items recorded their largest increases since the early 2020s.

US Earnings Revisions Breadth Continues to Inflect Higher

US earnings revisions breadth (ERB) has made a V-shaped recovery amid easing policy uncertainty. ERB of the US has overtaken that of international developed markets, and within the US, ERB of large-caps and technology stocks are far outpacing that of small-caps. Additionally, Q2 earnings growth for the Magnificent 7 is expected to meaningfully exceed that of the remaining S&P 493.

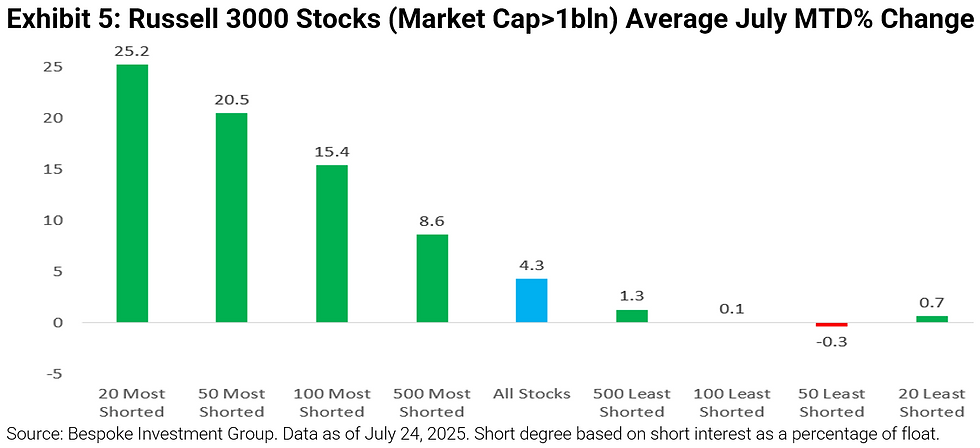

Heavily Shorted Stocks See Outperformance

Per Bespoke Investment Group, the 20 most heavily shorted stocks in the Russell 3000 Index were up over 25% on average from June 30th — July 24th. Meanwhile, all stocks only gained an average of 4.3%, and the least shorted companies returned even less. Is it time to consider taking profits and rotating out of these heavily shorted names?

Bitcoin Demand Surges

Bitcoin demand via ETF flows recently surged due to the passage of the GENIUS Act, which establishes a regulatory framework for stablecoins in the US. The legislation has sparked optimism to crypto investors as it signals broader institutional acceptance and increased legitimacy for the industry.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in SPYG, SPY, SPYV, SPDW, SPMD, SPSM, SPEM, SPBO, SPAB, MUB, IEF, SPIP, GLD, SLV, USO, and BCI on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Comments