The Rotation Has Been Underway. The Case for Thoughtful Diversification Grows Stronger

- Feb 2

- 5 min read

Broad Market Leadership Opens 2026

Despite early volatility driven by global bond market stress, tariff-related tensions, renewed inflation concerns, and uncertainty surrounding Federal Reserve leadership, equities finished January higher, with the S&P 500 reaching new all-time highs. On the back of strong economic data and earnings, market leadership broadened beyond mega-caps as the S&P 500 Equal Weight Index (+3.4%) outperformed its market cap-weighted counterpart (+1.5%). International developed equities (+5.8%) led gains, followed by US small-caps (+5.5%) and emerging market equities (+5.1%). Bonds mostly fared well as municipal bonds rose 0.7%, high yield credits gained 0.6%, and Treasury Inflation Protected Notes increased 0.5%. Commodities produced strong positive returns as silver was up 17.1%, crude oil gained 15.0%, gold rose 12.3%, and broad-based commodities increased 11.2%.

Fed Holds Rates Steady, Warsh to Succeed Powell

The Federal Reserve held the federal funds rate steady with a 10-2 vote at the January FOMC meeting, keeping the target range at 3.50—3.75%. This represents the first hold after three consecutive 25 bps cuts in 2025. The decision reflected some internal divergence, with Governors Stephen Miran and Christopher Waller dissenting in favor of an additional 25 bps cut. Recent indicators suggest that economic activity continues to expand with final Q3 GDP growth coming in at 4.4%. Meanwhile, job gains remain low, but the unemployment rate has declined from 4.5% to 4.4% in December. Inflation, however, remains above the Fed’s 2% target with annualized December Core PCE holding at approximately 2.8%. Looking ahead to the March FOMC meeting, market participants are currently pricing in over a 90% chance of a hold per the CME FedWatch Tool. In a notable development towards the end of the month, President Donald Trump announced the selection of Kevin Warsh as the successor to Jerome Powell as Chair of the Federal Reserve. Warsh, a former Federal Reserve Governor, is widely viewed as one of the more hawkish candidates considered, adding a new element of uncertainty to the policy outlook.

Consumer Confidence Hits 12-Year Low

Consumer confidence via the Conference Board survey fell to 84.5 in January, the lowest reading since May of 2014, with nearly all estimates missing economists’ expectations. At the FOMC meeting, Fed Chair Powell highlighted the survey, which shows households increasingly view the jobs market as getting tougher. The share of consumers saying jobs are hard to get reached its highest level since February 2021, while those reporting jobs as plentiful continued to decline. The survey also revealed waning optimism about business conditions and future income prospects, signaling that households are growing cautious, raising questions about whether this could prompt the Fed to cut rates sooner.

The Debasement Fade?

Debasement assets had a strong run last year and carried that momentum into the start of 2026. Silver and gold, up 163% and 173% over the past year, respectively, continued to rally as investors sought protection against inflation, a weakening dollar, concerns about Fed independence, and rising fiscal deficits. That narrative shifted late last week with the announcement that Kevin Warsh will succeed Jerome Powell as Fed Chair. Widely viewed as the most hawkish of the candidates, Warsh could signal a firmer Fed and help restore confidence in its credibility. His nomination also appeared to prompt a recalibration of market expectations, contributing to a 0.7% rise in the dollar on Friday, January 30th, and putting pressure on real assets such as gold and silver, which fell roughly 10% and 29%, respectively, for the day alone. Notably, the most recent and significant one-day gold decline of -6.4% on October 21, 2025, took 43 trading days to recover, highlighting the potential for a medium-term retracement. Recent weakness appears consistent with short-term consolidation rather than a change in trend. The structural drivers of debasement remain firmly in place, including persistent inflation, fiscal and geopolitical pressures, continued central bank gold buying, and a dollar likely to stay weak over the medium term, reinforcing the role of debasement assets as a portfolio hedge.

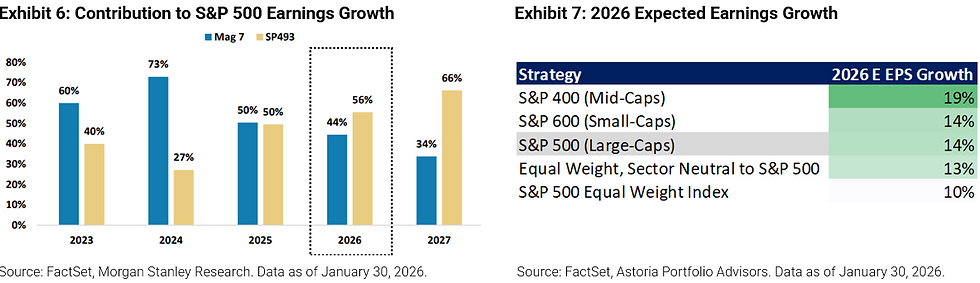

Earnings Growth Beyond the Magnificent 7

Looking at expected earnings growth for 2026, mid-cap and small-cap stocks appear particularly attractive, with S&P 400 mid-caps projected to grow EPS by 19% and S&P 600 small-caps by 14%, slightly ahead of the growth expected for large-cap S&P 500 names. Exhibit 6 shows that while the Magnificent Seven stocks have dominated earnings contribution in prior years, that of the 493 is projected to rise to 56% in 2026 and 66% in 2027, highlighting a broader set of stocks driving growth. This shift suggests opportunities beyond mega-cap names, as smaller and mid-sized companies are expected to contribute meaningfully to overall market earnings. Even equal-weight, sector neutral strategies targeting the S&P 500 are expected to see double-digit growth (approximately 13%), indicating diversification outside of large-caps can still capture strong earnings momentum. Overall, investors may find compelling upside in mid- and small-cap areas while still participating in growth from large-cap leadership.

The Rotation Has Been Underway. The Case for Thoughtful Diversification Grows Stronger

The market rotation that investors have suddenly been focusing on did not start last week or even last quarter. It has been underway since April of last year. Emerging markets, developed international markets, real assets, and large-cap money center banks have been quietly but meaningfully outperforming the S&P 500 since Q1 2025. Moreover, all cohorts among small-caps and mid-caps have outperformed the market since the Nonfarm Payrolls report was released on November 20th of last year. While headlines have remained fixated on a narrow set of US mega-cap winners, leadership beneath the surface has been broader for quite some time. Looking ahead, investors should prepare portfolios for a strong US economy. Earnings growth remains solid, GDP growth continues to surprise to the upside with Atlanta Fed GDPNow for Q4 tracking around 5%, and additional fiscal stimulus from the One Big Beautiful Bill Act could provide additional tailwinds. Layer in the prospect of further rate cuts, and the case for thoughtful diversification becomes even stronger.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in SPYG, SPY, SPYV, SPDW, SPMD, SPSM, SPEM, SPBO, SPAB, MUB, IEF, SPIP, GLD, SLV, USO, BCI, DXY, PPLT, PALL, and BTC-USD on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements

Comments